Form 8282 Vs 8283 . form 8282 vs.form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization.

from www.uslegalforms.com

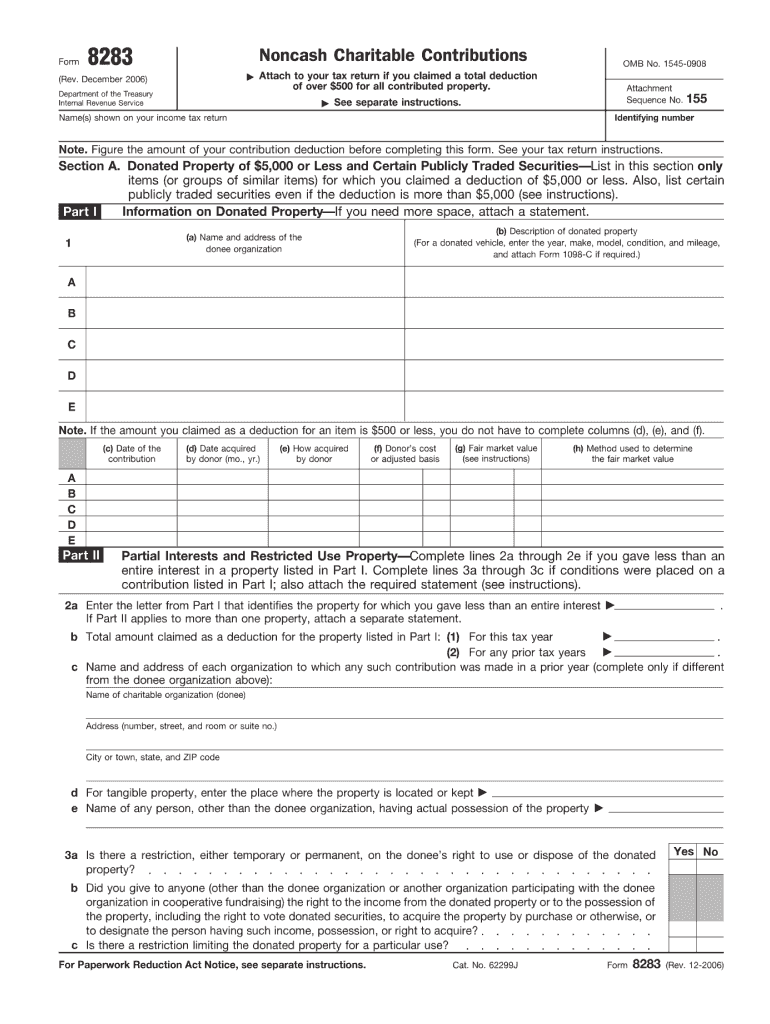

but your obligations may go further than that — for a noncash donation, you might also need to consider forms. form 8282 vs. prepare form 8283 for noncash contributions greater than $500.

Form 8283 Pdf 20202022 Fill and Sign Printable Template Online US

Form 8282 Vs 8283 While form 8283 is for donors to complete, form 8282 is the responsibility of the. While form 8283 is for donors to complete, form 8282 is the responsibility of the. section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities. form 8282 vs.

From www.uslegalforms.com

Form 8283 Pdf 20202022 Fill and Sign Printable Template Online US Form 8282 Vs 8283 section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated. form 8282 vs.form 8283 for donors.form 8283 has sometimes been utilized by the taxpayer. Form 8282 Vs 8283.

From www.formsbirds.com

Form 8283V Payment Voucher for Filing Fee under Section 170(f)(13 Form 8282 Vs 8283 section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities. form 8282 vs. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated. prepare form 8283 for noncash contributions greater than $500.form 8283 for donors. Form 8282 Vs 8283.

From biokunststoffe.org

Irs Form 8283 Instructions Form 8282 Vs 8283form 8283 for donors. form 8282 vs. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated. section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities.form 8283 has sometimes been utilized by the taxpayer. Form 8282 Vs 8283.

From www.vrogue.co

Form 8283 Cost Basis Fill Online Printable Fillable B vrogue.co Form 8282 Vs 8283form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization.form 8283 for donors. prepare form 8283 for noncash contributions greater than $500. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated. While form 8283 is for donors to complete, form 8282 is the. Form 8282 Vs 8283.

From www.investopedia.com

Form 8282 Donee Information Return Overview Form 8282 Vs 8283form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization. While form 8283 is for donors to complete, form 8282 is the responsibility of the. prepare form 8283 for noncash contributions greater than $500. section a of form 8283 is used to report noncash contributions of $5,000 or less and to report. Form 8282 Vs 8283.

From taxhow.net

TaxHow » Feel Like Donating? Form 8283 Gives You Something Back Form 8282 Vs 8283 the original donee is also required to sign form 8283, noncash charitable contributions, section b donated.form 8283 for donors. section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities. but your obligations may go further than that — for a noncash donation,. Form 8282 Vs 8283.

From thegivingblock.com

Form 8282 What Nonprofits Need to Know The Giving Block Form 8282 Vs 8283 but your obligations may go further than that — for a noncash donation, you might also need to consider forms. form 8282 vs. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated. prepare form 8283 for noncash contributions greater than $500. section a of form 8283 is used. Form 8282 Vs 8283.

From www.formsbank.com

Instructions For Form 8283 printable pdf download Form 8282 Vs 8283form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization. While form 8283 is for donors to complete, form 8282 is the responsibility of the. prepare form 8283 for noncash contributions greater than $500. form 8282 vs. the original donee is also required to sign form 8283, noncash charitable contributions, section. Form 8282 Vs 8283.

From www.slideserve.com

PPT Polity Class Financial Support Services 1. Church Taxes & Finance Form 8282 Vs 8283 form 8282 vs. While form 8283 is for donors to complete, form 8282 is the responsibility of the. section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities. but your obligations may go further than that — for a noncash donation, you might also. Form 8282 Vs 8283.

From www.formsbirds.com

Form 8282 Donee Information Return (2009) Free Download Form 8282 Vs 8283 prepare form 8283 for noncash contributions greater than $500. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated.form 8283 for donors. but your obligations may go further than that — for a noncash donation, you might also need to consider forms.form 8283 has sometimes been utilized. Form 8282 Vs 8283.

From www.formsbank.com

Fillable Form 8282 (Rev. December 2005) Donee Information Return Form 8282 Vs 8283 the original donee is also required to sign form 8283, noncash charitable contributions, section b donated. form 8282 vs.form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization.form 8283 for donors. but your obligations may go further than that — for a noncash donation, you might also need. Form 8282 Vs 8283.

From investors.wiki

Form 8283V Investor's wiki Form 8282 Vs 8283 prepare form 8283 for noncash contributions greater than $500.form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated.form 8283 for donors. form 8282 vs. Form 8282 Vs 8283.

From form-8283-instructions.com

Irs Form 8283 Instructions 20212024 Fill online, Printable, Fillable Form 8282 Vs 8283 the original donee is also required to sign form 8283, noncash charitable contributions, section b donated.form 8283 for donors. While form 8283 is for donors to complete, form 8282 is the responsibility of the. but your obligations may go further than that — for a noncash donation, you might also need to consider forms.form. Form 8282 Vs 8283.

From taxhow.net

TaxHow » Feel Like Donating? Form 8283 Gives You Something Back Form 8282 Vs 8283 but your obligations may go further than that — for a noncash donation, you might also need to consider forms. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated.form 8283 for donors.form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization. Web. Form 8282 Vs 8283.

From www.taxdefensenetwork.com

How to Complete IRS Form 8283 Form 8282 Vs 8283 While form 8283 is for donors to complete, form 8282 is the responsibility of the. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated.form 8283 for donors. form 8282 vs. but your obligations may go further than that — for a noncash donation, you might also need to. Form 8282 Vs 8283.

From www.formsbank.com

Instructions For Form 8283 printable pdf download Form 8282 Vs 8283 form 8282 vs. While form 8283 is for donors to complete, form 8282 is the responsibility of the. but your obligations may go further than that — for a noncash donation, you might also need to consider forms. the original donee is also required to sign form 8283, noncash charitable contributions, section b donated. section a. Form 8282 Vs 8283.

From pdf.wondershare.com

Instructions for How to Fill in IRS Form 8283 Form 8282 Vs 8283 form 8282 vs.form 8283 for donors. section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities. While form 8283 is for donors to complete, form 8282 is the responsibility of the. but your obligations may go further than that — for a. Form 8282 Vs 8283.

From www.thetaxadviser.com

When Is Form 8283 Required to Be Filed? Form 8282 Vs 8283 section a of form 8283 is used to report noncash contributions of $5,000 or less and to report contributions of publicly traded securities.form 8283 has sometimes been utilized by the taxpayer as acknowledgement from the recipient organization. form 8282 vs. While form 8283 is for donors to complete, form 8282 is the responsibility of the. Web. Form 8282 Vs 8283.